Economies in Asia have been growing rapidly over the last decade due to the exponential use of fossil fuels in the region. But exactly how dependent are these countries on oil, especially foreign oil? And how does it affect their national security?

To understand the context of the question we are asking, let’s take a look at Asia’s top 4 economies (excluding South Asia and Oceania). The top GDP in Asia, unsurprisingly, is China with 5.8 trillion USD. While Japan follows behind quite closely with 5.5 trillion USD, South Korea and Indonesia ‘s GDP are much lower at 1 trillion USD and 706 billion USD, respectively. By understanding the size of these economies, we can now examine the energy mix of each country to see the impact that oil has on each country.

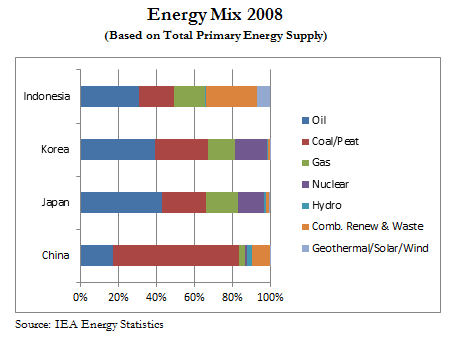

Among these 4 economies, Japan and South Korea use the most oil in their energy mix. These two countries are among the most resource deprived countries in the world and require the majority of their energy to be imported. Japan’s energy mix relies heavily on oil, which accounts for 43.2% of the country’s total energy supply. South Korea, is similar, with oil accounting for 39.5% of the country’s total energy supply.

China and Indonesia, on the other hand, have a number of domestic resources that have relieved oil as the country’s predominant energy source. China, for instance, holds the world’s 2nd largest coal reserves. This is directly reflected in their energy mix as coal represents 66.5% of total energy supply. The second most used energy source is oil, at 17.2%, a much smaller percentage than both Japan and Korea. Indonesia, on the other hand, is endowed with rich natural resources, including oil, gas, hydro-power, and expansive forests and agricultural farmland. Due to this fact, Indonesia’s energy mix is the most balanced among the 4 economies. Indonesia’s oil dependence is at 30.9%, with Combined Renewable and Waste fuels coming in second with 26.7%. Indonesia also combines equal shares of coal, natural gas, and renewable energies into their energy mix, making them the most diversified and least vulnerable among the 4 economies.

So, how much influence does foreign oil actually have in these four economies?

China:

Although, the majority of China’s energy mix is dominated by coal, oil still plays a large role in China’s growing economy. China used to be a net oil exporter in the early 1980s, when the country’s largest oil field- Daqing- was producing oil for domestic and foreign markets. Daqing, combined with China’s coal reserves, made the country very secure as their energy needs were independent from the whims of the international energy market at the time.

However, since 1993, Daqing’s reserves have significantly declined, making China a net importer. Combined with China’s exponential growth during the 1990s and early 2000s, the country is now 52% reliant on foreign oil. This number is projected to grow over the next 20 years as the Chinese government struggles to subsidize domestic oil production. This will not only make domestic oil much more expensive, but will also force the government to become more dependent on the international oil market.

Although China energy mix only contains 17.2% of oil, in absolute numbers this amounts to 8,324,000 barrels per day (bpd) in 2009. This is already almost double that of Japan’s daily consumption of oil, who’s share of oil usage is much greater than that of China at 43.2%. Moreover, China’s continuing development has also produced produced a strong consumption culture, as middle-class Chinese citizens wish to acquire private cars for their transportation needs. Private car use is already increasing steadily at 12% a year and with China’s current population size of 1.3 million, this will make China the world’s next largest car market and oil importer if new bio-fuel or electric vehicle (EVs) technologies are not introduced. This has large implications for China’s socioeconomic stability and energy security, as the country is expected to provide a better life for its citizens while the country becomes more vulnerable to the global oil market.

Japan:

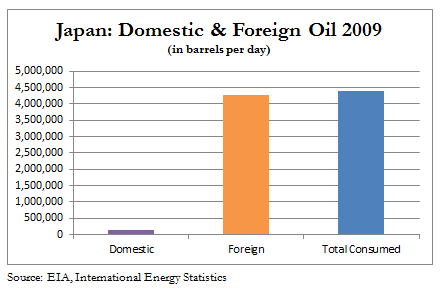

Among these 4 economies, Japan is the second most reliant country on foreign oil at 97% (behind South Korea). Japan does not hold any domestic energy sources and has for years been importing energy from all over the world. It is constantly at risk, as any shock to fuel prices, oil supply, or blocks to oil tankers will affect the island nation.

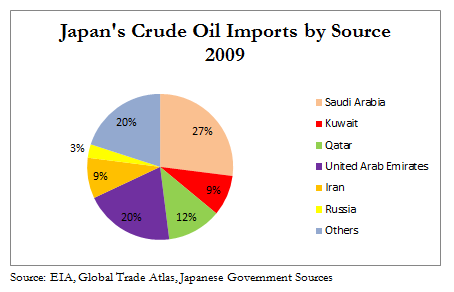

Japan’s unique position has made the country driven to increase energy efficiency in all sectors of society through the implementation of energy efficiency standards and technology. Although these policies have slowed down the growth of Japan’s energy demand, oil still continues to play a large share of their energy needs and the island nation continues to be constrained by this energy security risk. For instance, Japan is overwhelmingly supplied by Middle Eastern sources, and continues to be vulnerable to oil supply shortages and price shocks. These concerns are at the forefront of Japanese energy policy, and plans to diversify oil sources, invest in renewable energy, and incorporate more natural gas, nuclear, and coal into their energy mix are always present.

Japan’s unique position has made the country driven to increase energy efficiency in all sectors of society through the implementation of energy efficiency standards and technology. Although these policies have slowed down the growth of Japan’s energy demand, oil still continues to play a large share of their energy needs and the island nation continues to be constrained by this energy security risk. For instance, Japan is overwhelmingly supplied by Middle Eastern sources, and continues to be vulnerable to oil supply shortages and price shocks. These concerns are at the forefront of Japanese energy policy, and plans to diversify oil sources, invest in renewable energy, and incorporate more natural gas, nuclear, and coal into their energy mix are always present.

South Korea:

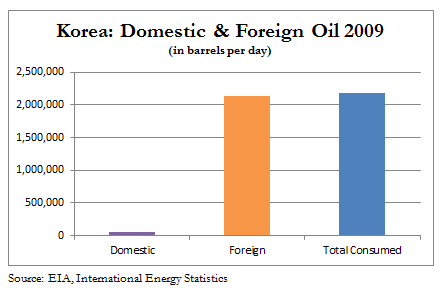

South Korea represents a similar situation with Japan as the country is the most reliant on foreign oil among the 4 economies in this article. South Korea holds a small amount of domestic resources and imports almost 98% of its oil from overseas suppliers. However, South Korea holds a unique niche in the oil industry as the country’s shipping industry and oil refineries help secure the country’s crude oil supplies. For instance, South Korea has 3 of the world’s top 10 largest oil refineries. Their refineries are technologically advanced and are capable of refining “sour” or high sulfuric oil into petroleum products. This is in contrast to much older refineries in the region, that are used to refining easier “sweet” or low sulfuric oil found in Asia in the past. This has made South Korea one of the centers of oil refining in Northeast Asia, allowing them to process over 2.5 million barrels of oil per day in 2009.

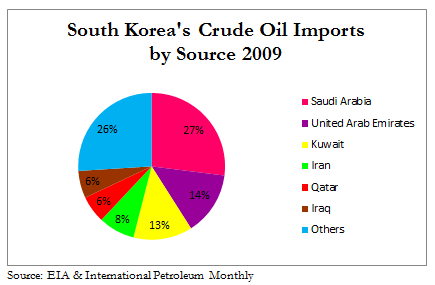

However, this position has also made South Korea vulnerable to oil shocks as the country is now highly dependent on oil exports from the Middle East which account for 83.3% of the country’s total oil imports in 2011. South Korea, at the moment, does not have even one non- Middle Eastern oil source (unlike Japan who has Russia) and continues to fear for supply disruptions.

Despite these problems, South Korea holds significant capital allowing it to hedge for a better energy security future. For example, the South Korean government has continued to invest heavily in oil rich nations to help with exploration and production, while securing stakes in the oil to be produced. Earlier this year, Korea National Oil Corporation secured a combined 1.7 million barrels of oil from the United States and Kazakhstan. The same corporation also increased its stakes in the United Arab Emirates, allowing it to increase the country’s ownership of foreign oil to 10-15% of their total consumption. These overseas activities are only part of South Korea’s strategy as they acknowledge their continued oil dependence.

Indonesia:

Indonesia has the smallest economy of the 4 being studied and is also the only country from Southeast Asia. Yet, it is one of the few countries in Asia blessed with abundant natural resources- oil, natural gas, coal, copper, tin, forests, etc. These natural resources have for years helped Indonesia’s economy grow exponentially while maintaining a large degree of independence from foreign energy sources. But since 2004, Indonesia has become a net importer of oil causing the country’s political leaders to be concerned over their future energy security.

At the moment, Indonesia only imports 17.5% of foreign oil due to the country’s continued dependence on fuel subsidies that has artificially made Indonesian oil more affordable for citizens. This has amounted to 10% of their GDP or 10 billion USD on fuel subsidies for 2010. This policy is not sustainable, however, and will threaten the stability of Indonesia in an economic crisis when the government will be incapable of paying subsidies (like when the Indonesian Rupiah lost its value in the Asian Financial Crisis of 1997/1998).

As a result, the government has been looking for other ways around this problem. In 2006, Presidential Decree No. 5/2006 declared that the Indonesian economy should diversify its energy mix and move away from its dependence on oil. As a result, local governments implemented the usage of more natural gas, coal, hydro-power, and biomass into the power sector. But oil still remains as the country’s most used fossil fuel. Indonesia will continue to be dependent on oil in the coming years, and will need to expand their petroleum activities overseas, upgrade their refineries, and invest or collaborate with foreign oil companies to ensure the needs of their country. This will enable them to develop diplomatic relations with oil-rich nations, have stakes in overseas petroleum fields, and reduce their vulnerability by producing their own refined oil products.

Great stuff Diana, keep it up!

Thanks for the share! Very useful info!