The New EV Consumer Profile is highly correlated to the current luxury market, make EVs a status symbol and Chinese Consumers will buy.

The New EV Consumer Profile is highly correlated to the current luxury market, make EVs a status symbol and Chinese Consumers will buy.

Clean technology, renewable energy, eco-cities and the like have been buzz words in China for the past couple of years. Millions of dollars has been invested in these technologies, allowing China to now lead in the largest total capacity for renewable energy in the world. However, as a share of China’s total energy, renewable energy amounted to less than 15% in 2008 (this includes comb. renewable & waste, hydro, geothermal, wind, and solar).

China and the rest of the world still have a long way to go until they become sustainable, renewable, and environmentally friendly. However, China continuously looks for ways in which to decrease its fuel dependency on foreign countries. Recently, China has been charged by American Solar PV companies for unfairly “dumping” solar cells in the U.S. market, disallowing American Solar PV manufacturers to compete fairly. But as these companies fight for more protectionist measures, China takes its next step by being the first movers in the next generation of electric vehicles. This will once again help China place as the world’s market leader, allowing for the innovation of cheaper and better batteries, infrastructure, and vehicle design.

The only problem is, how do you get Chinese citizens to start buying these low-carbon, energy efficient vehicles?

The Government’s Failing Efforts

EVs have been promoted because of their energy efficiency and low urban pollution profile. They also have the capability to reduce China’s ridiculous dependency on foreign oil.

However, many are hesitant to embrace the new technology due to the current lack of infrastructure and investment. Recently, the government has implemented national and local initiatives to make the technology cheaper and more convenient. For instance, these initiatives are used to bolster EV consumer convenience, as seen in city of Beijing, where city officials have committed to increasing the amount of charging stations to 256, for distribution stations to 210, and charging posts to 42,000. At the moment, Beijing has only for 19 charging stations and is unprepared for the projected 100,000 EVs to be on Beijing’s streets by 2015.

The central government, on the other hand, has already committed to investing “$15 billion… over the next five years” for vehicle electrification and infrastructure. They have also promised potential EV consumers subsidies of up to $10,000 USD to offset the price of the battery and technology. The Beijing Municipal Government has even suggested the exemption of EVs from their license plate lottery system. These governmental policies have all aimed at enticing everyday Chinese citizens to buy electric vehicles, but at the moment, these initiatives are not strong enough to tempt them.

What is holding Chinese Consumers back?

So, why have these initiatives not been able to dramatically increase the sale of EVs in China?

To answer this question, we need to have a closer look at the amount of interest Chinese consumers hold for EVs. Initial reports on consumer interest in EVs from management consulting firm McKinsey & Company in 2009-2010 was hardly optimistic. The report focused on the Shanghai automobile market, illustrating the “lack of confidence” consumers had with EVs at the time for their “inconvenience of charging, insufficient mileage endurance and lack of confidence in technological stability and reliability.” This led to only 3.8% of respondents to even consider purchasing an electric vehicle. The worst part was that even with hypothetical government subsidies of $4,400 USD, this number increased only 1.4% to a total of 5.2% of McKinsey’s survey group.

Deloitte Consulting followed up with an expanded survey this year and found Chinese consumer requirements have stayed relatively the same. For instance, the study showed that it would take a substantial and quick oil shock for even 50% of respondents to consider EVs and to get this number up to 75% is highly unlikely. In addition, there is also a negative correlation with fuel efficiency to consumers willingness to consider an electric vehicle. For instance, if internal combustion engine cars can achieve fuel efficiency levels of “3.0 liters per 100 kilometers” then 82% would be less willing to buy an electric vehicle. Chinese consumers (55%) also expect battery charging time to be around 2 hours, which is in complete contrast to the full 8 hours that current EVs require. In terms of price, 44% of Chinese respondents expect to pay the same price for an electric vehicle as they would an internal combustion engine car, while “only 14% are willing to pay a price premium of more than 20,000 RMB (US $3,055).” The realities of EV pricing when compared to consumer expectations, despite government subsidies of a reported $8,800–10,000 USD, are currently not low enough to interest regular Chinese consumers.

What Do I Need to Know About the Automobile Market in China?

Market Potential for EVs

At the moment, researchers have forecast that Chinese citizens will be the leading buyers of EVs by 2015 in the Asia-Pacific. Firms such as Pike Research claim that China will represent “half of the region’s total sales” in the next 4 years. Others have indicated that China’s EVs market will represent about “10-15%” of China’s total car consumption by 2020. In total numbers, this could amount to a potential market of 4-6 million electric vehicles (Calculated from 2020 forecast of 40 million new cars).

Current Market Preferences

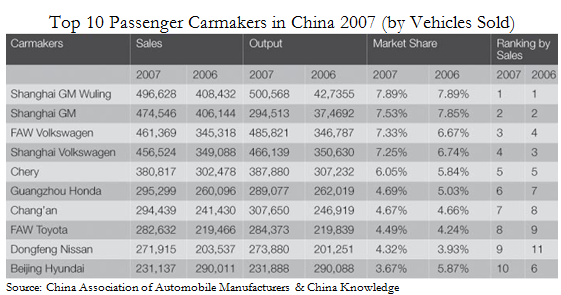

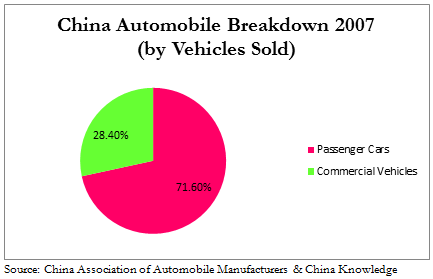

The 2010 automobile market was 18.1 million and is expected to grow “15 percent this year.” The vast majority of these automobiles are for private use, where in 2007 this category accounted for 71.6% of all cars sold. Moreover, Deloitte’s survey suggested that the vast majority of Chinese automobile consumers want a mid-sized sedan (43%), while small sedans and hatchbacks represented 36% and 9%, respectively.

Of these vehicles sold, foreign brands represent the top pick for Chinese consumers. Shanghai GM Wuling, Shanghai GM, and FAW Volkswagen take the top three spots, with only the only domestic automobile maker Chery represented. This is because foreign brands have not only recognition but are also linked to quality, reliability, stability, and status. On the other hand, domestic vehicles, although cheap, are not reliable and have a bad reputation for “breaking down after two years.”

To Sell EVs, Make Them A Status Symbol

The EV Consumer Profile

With a country of 1.3 billion people and a GDP per capita of only $3,744 USD in 2009, the majority of Chinese citizens do not have the capacity to buy a car, nonetheless an electric vehicle that is said to cost upward of $30,000 USD. However, identifying segments that would be interested in electric vehicles in China is not that difficult through the analysis of China’s current consumer preferences and Deloitte and McKinsey & Co’s consumer surveys.

Despite the fact that the majority of Chinese citizens have not considered electric vehicles, there is a segment of the society that would be willing to be the “first movers” on the EV train. In Deloitte’s survey, these individuals are those that are well-educated (Bachelors degree or higher), live in urban areas, belong to middle or upper classes, and they tend to be male. They also identify themselves as environmentally conscious individuals and see EVs as another aspect of their “tech-savvy[ness],” “trend[iness],” and overall “coolness.” These first buyers also tend to be well-informed about their society and governmental policies, allowing them to be stylish yet more environmentally friendly than their peers. As a result, the new EV consumer profile is closely correlated to today’s luxury car market (without the environmentally conscious aspect), explaining not only China’s preference for foreign cars but their need for status and prestige.

The Counter-intuitive Truth: To Make People Want EVs, Put Them Out Of Reach

Walking along the streets of Beijing today, the most numerous and recognizable car brands are Audi, GM, and Volkswagen. In today’s China, capitalism and consumption have taken over as the traditional fabrics of society erode. Reports of students and young adults using their entire salary for the newest electronic devices are real, illustrating the competitiveness for “perceived” status in the society. Luxury cars are very much part of this game and are now the “it” commodity in the market today. However, luxury cars such as China’s coveted Audi A6 (preferred choice for government officials and CEOs) are becoming more commonplace now, making it hard to differentiate between the newly affluent and the super rich.

This void can now be filled in by electric vehicles as the super rich search for another identity to call their own. In this strategy, car producers will need to aggressively market EVs as a luxury product that is not only esteemed but also discreet (Similar to Audi’s reputation in China, where other German luxury brands are considered too “loud” and therefore, too arrogant).

The first EVs launched into the Chinese market will need to be manufactured by a recognizable foreign brand, or as part of a luxury car group (i.e. SmartCar Ala Mercedes Benz). It’s design will need to be sophisticated, trendy, and almost “couture” to illustrate the almost untouchable nature of the car. Yet, at the same time, allow normal middle class citizens the dream of one day owning it. It should also be marketed in a way that illustrates the esteemed nature of their user, as they consciously decided to forego traditional luxury cars to benefit their society. Meanwhile, the car should also portray an underlying message that the super rich have higher moral values, illustrating how money and an internal combustion engine (ICE), does not add to society, culture, or the betterment of the environment. This strategy would be able to tap into the status-conscious minds of today’s Chinese consumers while correctly identifying with the consumer segment most likely to buy EVs.

By marketing EVs in this way, car manufacturers will have more time to reduce costs and improve battery functions of future generations of EVs. At the same time, middle class consumers will begin striving toward EVs as the next level of wealth prominence. In this way, EVs will be able to mimic the same trickle-down effect seen in China’s current ICE market, where middle class families strive for prestige through the ownership of luxury cars, while lower to lower-middle class strive for foreign car brands. Through this strategy, electric vehicle car manufacturers would be creating an entire lifestyle catered to those who are educated, affluent but not flashy, and environmentally conscious. This will enable them not only to elevate their position in society but also make them enviable as normal citizens covet their electric vehicles and green lifestyle.

I think the easiest and fastest approach to deploy EV in China is the public transportation, and government fleet. They have regular route, monitored usage, professional workers to maitain at well designed garage. The great majority Chinese people live in high-rises. They don’t own garages for EV. That could lead to a big safety concern. The big range of urban, and congested road condition can be hurdles too. If drivers have to sacrify the enjoyable audio even AC to save the battery. It will be hurt… Anyway, the PHEV should be designed for the present technology and daily consumers. The big leap to pure EV for China is not realistic.

I agree with you Liang that deploying EVs in public transportation and the government fleet would be easiest. However, many government officials prefer luxury cars (mainly Audi) and the need to make EVs attractive and “special” enough to this group is important to make a sweeping change in the current govt. fleet.

Furthermore, I believe there are way more problems with deploying EVs at the moment as you have pointed out. But the transition would need to be slow and the government’s current stance on giving away license plates to EV buyers is not a good move since it’ll will only congest more of the urban traffic.

Great article. I appreciate the research that has gone into this, and I think that based on US sucess with the Tesla roadster (which needed 18 hours of charging, the last time I asked…couple years ago) and some other flashy, expensive electric vehicles, it is indeed a great direction to go in.

At this time, I am not aware of any vehicles or brands in China that could genuinely produce such a vehicle. Given that there are no real Chinese luxury brands outside of the JVs such as Audi, Brilliance BMW and Beijing Benz, and that those auto-makers are not likely to share their top-end EV technology with Chinese JVs quite yet, we are left with BYD, Zotye, and some other vehicle companies that have no ability to put out a recognized luxury-label vehicle.

Import vehicles won’t receive any subsidy without domestic manufacturing – in fact, they will be subject to regular import taxes, so it will be a really hard sell, even to the greenest of the greens.

This is a great direction though, and if any Chinese auto company can develop proven, safe and comfortable EV technology, they would be well-advised to go for the high-margin, luxury vehicle segment!

See you at BEN!

Thanks Rob for your comments. I agree that China does not have the domestic capability to create a luxury-labeled electric vehicle yet. And I also agree that it would be more expensive to have an import vehicle carrying this type of technology.

But based on the current Chinese consumer mindset and how the government is promoting EVs, the cheaper segment has not really caught on even with the exemption of EVs from the lottery license plate scheme and subsidies of up to 10,000 USD. Many people are looking at this from the bottom-up direction, and have not realized that the current auto industry is based on displaying wealth and status through increased comfort and convenience. EVs can be a leader in this segment even if they are deployed through imported brands. If you are targeting this segment, price would not be the main concern but providing the lifestyle is.

However, there will be challenges along the way as it will take a lot of time, money, and dedication to deploy this type of large-scale marketing scheme for EVs. And this has not even mentioned the government infrastructure needed to make EVs viable.

I would love to discuss this more with you, see you tomorrow at BEN!

Didn’t end up seeing you at BEN – can you e-mail me at the e-mail I supplied to your website? Thanks!

Rob

This is a very interesting marketing strategy, and it is actually pretty sound! If the price of EVs cannot compete with ICE cars, then let’s take advantage of the high price and make it a luxury good. Being green is a fashion in China. There is not too much advertising going on in China right now, and if we can have some celebrities use EVs first, that will even get bigger impact. Because wealthy people also tend to have private parking or single house, it is easier for them to charge EVs than normal people.

Interesting talk.

More EVs in high end market will be a symbolic change, but the market is small.

The government is the biggest player in this China. I’ll be happy to see mandate targets of EVs in public transportation sector.

— a laymen of EV technology

Great article and interesting points of view but we’re dealing with desperate times with pollution/smog killing people .I really like the idea of all public transportation and municipal vehicles mandated EV’S. We’re dealing in serious health issues and the bigger cities must have a government subsidized trade in program that will give owners of motorized vehicles book value for their automobiles + another 20% value towards the purchase of EV’s. The government would then sell those cars to other provinces where pollution isn’t as big of an issue for book value -20% of their value. Yea it will cost big time but desperate times call for desperate measures and safety and health of the people is number 1. Secondly,installing charging stations throughout China has to be a top priority 10,000 per week possibly. Lastly, the government has to push hard in letting the people know how serious it is by advertising in every paper daily, magazines on television. This campaign can’t stop until people buy into it. The same way anti-smoking campaign is working.