China dreams of energy independence via shale gas, but challenges abound due to geography, infrastructure, and water.

In recent years, much attention has been paid to shale gas, an unconventional natural gas that was traditionally found to be too expensive to extract. But with rising fossil fuel costs and technological innovation, the United States has made shale gas into a serious game-changer for the future trade of natural gas around the world.

Countries, such as China, are now finding ways to tap into this resource to boost their national energy security. But how accessible is Chinese shale gas and what problems does the production of this unconventional gas face in the People’s Republic of China?

Estimates and the Reality

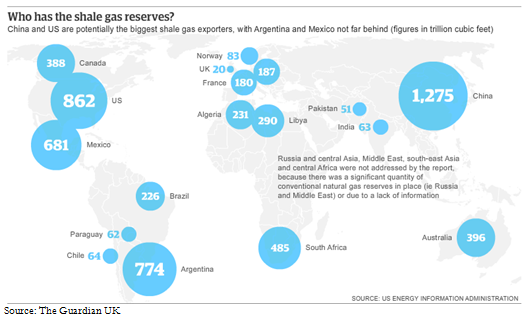

In April 2011, the U.S. Department of Energy’s Energy Information Administration (EIA) released estimates on the world’s technically recoverable shale gas reserves. The report garnered mixed reviews as it placed China as the leading holder of shale gas reserves in the world with “36 trillion cubic meters,” while the United States followed closely behind at “23.4 trillion cubic meters.”

But can China actually dominate the shale gas market?

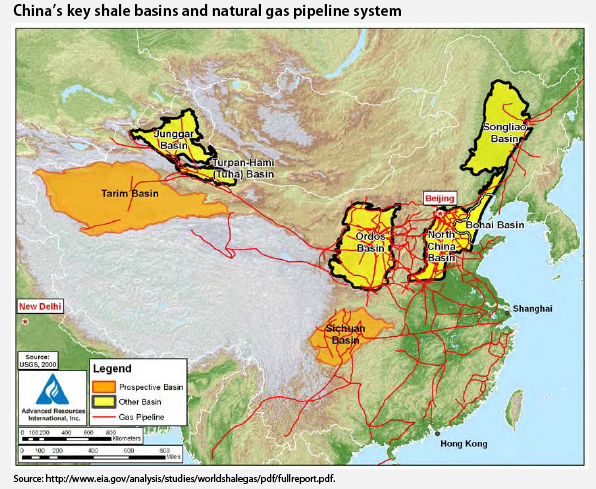

EIA’s claims were unfounded as China was only beginning to identify and explore domestic shale rock basins. Since then, however, Beijing has been able to suggest that 2 out of the country’s 7 shale rock basins (Tarim and Sichuan Basins) could be commercially produced. With the help of joint ventures with BP (Sinopec), Total (CNPC), and Royal Dutch Shell (PetroChina), China began exploratory drilling in Sichuan in 2010. These joint ventures have found “major shale gas reserves in… [the]western Sichuan region” and have helped Chinese energy companies practice shale gas technologies. More importantly, these initial drillings have helped the government, specifically the Ministry of Land and Resources (MLR), survey China’s actual recoverable shale gas reserves. MLR now believes China holds “25 trillion cubic meters” of exploitable onshore shale gas. This is 11 trillion cubic meters less than the estimate EIA had proposed earlier, dropping China’s abilty to meet demand (at current rate of consumption) from about 400 to 300 years.

Difficulties in Commercially Developing Shale Gas in China

Faced with criticism to reduce carbon emission and reduce dependence on foreign fossil fuels, the Chinese government is set to move ahead with shale gas exploration and production. Earlier this year, the government has set targets for “developing 6.5 bcm of shale gas per year by 2015” and moving exponentially “up to 60-100 bcm by 2020.” However, are these targets practical? More important, what difficulties does China face in making shale gas commercially available in the near future?

Difficulties in Geography

The production of shale gas is technologically challenging since “water, sand, and chemicals” are used to blast deep into wells to allow shale gas to come to the surface. This technology, also known as hydraulic fracking, is the key element that has drastically changed the unconventional natural gas industry in the U.S. However, unlike the U.S., China’s shale rock is much more geographically challenging.

Chinese shale gas is found in much rougher terrain and is found much deeper underground than American shale gas. American shale gas can be typically found within “two to six kilometers deep, whereas in China some key deposits are found six kilometers deep.” To developers, this means that experiences learned in the U.S. may not be readily applied to China as the geographical challenge will require more experienced personnel, additional equipment, technological innovation, and increased costs. This will be especially the case when exploring and developing Sichuan Province, an area prone to earthquakes.

The quality of the shale rock and gas in China is also different than the U.S. The shale rock, for instance, is “non-marine” and contains much larger amounts of clay than its North American counterpart. This means that it is “more difficult to be fractured” and will require much more energy and highly skilled human capital to produce the same amount of gas. Chinese shale gas is also inferior to American shale as it contains much more “non-hydrocarbon gasses.” The lower quality gas may be costly in the long-term as China may be forced to develop ways in which to refine the gas into a more usable state.

Lack of Infrastructure

Many of China’s shale gas reserves are located in rural areas that lack basic infrastructure such as roads, railways, electricity, and gas pipelines. Without these transportation features, each level of shale gas development will be stalled. For example, without substantial roads, developers will be unable to carry in the necessary vehicles, sand, chemicals, and steel needed to create exploratory wells. China also faces a bottleneck in transporting shale gas as the country lacks an extensive gas pipeline network. More pipelines or liquefied natural gas centers will need to be built near shale gas wells in order to make the unconventional gas more commercially viable.

In addition, China will need to adopt or develop infrastructure that can safely dispose of the contaminated material used to “frack” the shale rock. This will protect the environment, as well as help reclaim land that was used to drill into the earth. These factors are important as they will reduce costs caused by environmental damage and the chances of earthquakes occurring in the future. Moreover, these precautionary steps will also help China exponentially speed up their well development timeline (PetroChina took 11 months to complete the country’s first horizontal well).

Water Shortages and Suitability

One of the larger problems facing shale gas development in China is the shortage of water. Water is a necessary component in the process of hydraulic fracking, with no other alternative at the moment. In shale gas rich Sichuan Basin, this is of extreme concern due to the region’s agricultural heritage which provides the country with about “7 percent of China’s rice, wheat, and other grains.” Diverting water from the agricultural sector to shale gas could be devastating, especially if the contaminated water also contaminates China’s farmlands.

For other shale gas basins in Tarim, Xinjiang, and Inner Mongolia, water shortage is a real challenge due to the arid and hot climate. Shale gas development will require water to be transported from other parts of the country, a feat that is expensive as it is momentarily impossible.

Although the Chinese government places high hopes on shale gas, much more still needs to be done. In my next post, I will compare the political environment that made shale gas successful to the U.S. and what China still needs to do to compete. Subscribe now to get the latest updates.

Check out other articles on China below:

What are your thoughts about solar power in China? Large swathes of land and desert…

Pingback: Why China Lags Behind the U.S. in Shale Gas Development « Energy in Asia

You mentioned that “The quality of the shale rock and gas in China is also different than the U.S. The shale rock, for instance, is “non-marine” and contains much larger amounts of clay than its North American counterpart. This means that it is “more difficult to be fractured” and will require much more energy and highly skilled human capital to produce the same amount of gas.”

This is actually not accurate, despite what the article you link to says. If you actually read the EIA report from 2011, it states that a defining feature of the Tarim and Sichuan basins (the two largest basins) is that they are low-clay due to their deepwater marine depositional environment. So their porosity is actually pretty good and well-suited to fracking, and they are marine, not non-marine.

I go to see every day a few web sites and information sites to read content, but this webpage offers feature based articles.

my blog post – quote (Frankie)