-

Majority of oil fields located far from ISIS controlled areas; Iraq’s oil industry largely unaffected in short-term

-

Iraq’s top export countries to be affected if ISIS moves south of Baghdad

-

Iraq oil industry to suffer standstill in investment, infrastructure, and human capital

In June 2014, ISIS (Islamic State of Iraq and Syria) launched an offensive on Northern Iraq, specifically targeting the country’s second largest city- Mosul. ISIS successfully took control of Mosul, and has since been consolidating its power and forces among the Sunni Muslim minority community.

ISIS seeks to establish an Islamic caliphate in the Middle East, primarily in Iraqi and Syrian territory. Driving aggressively towards this goal, ISIS has been recruiting thousands of soldiers to join their military. In order to finance their ambitions, they have been selling oil on the black market.

Who is ISIS?

ISIS (Islamic State of Iraq and Syria), also known as IS (Islamic State) and ISIL (Islamic State of Iraq and the Levant), is an insurgency group made up of militant jihadist Sunni Muslims.

The group was established in 2003 as a branch of Al-Qaeda. In 2014, Al-Qaeda severed ties with the group due to their use of extreme violence toward Shia Muslims and Christians. Since the fall of Saddam Hussein’s regime, they have been gaining traction in Iraq due to the government’s political discrimination of Sunni Muslims in Northern Iraq. At the moment, the group has a reported 10,000 fighters among their ranks in both Syria and Iraq.

Why Iraq?

ISIS has made a strategic move by targeting Iraq. Iraq is well-endowed with natural resources, where in 2011 Iraq’s hydrocarbon industries made up 72% of the country’s total GDP.

The country currently holds the world’s 5th largest proven oil reserves (141 billion barrels) and has been slowly ramping up production since the end of the Iraq War. Moreover, the unstable political environment and political discrimination of Sunni Muslims in Northern Iraq has given ISIS a built-in community from which to recruit fighters and supporters.

ISIS’s Territorial Control

Iraq’s Oil Fields

Iraq’s Hydrocarbon Resources

Iraq has eight supergiant oil fields. Six of these supergiant oil fields are found in Southern Iraq and account for 60% of the country’s proven oil reserves. The remaining two are located in the north and central part of the country. As of April 2014, Iraq was reported to be producing an estimated 3.3 million barrels per day, making up 4% of the world’s oil supply. Of the 3.3 milllion barrels per day produced, 75% is reported to be produced from the south and 25% from the north and central regions of Iraq.

As of August 2014, ISIS currently controls many Northern and Northwestern provinces of Iraq. Notable cities include: Mosul, Tal Afar, Sinjar, and Fallujah. The city of Zumar and the Ain Zalah oil field in the Kurdistan Regional Government has also recently fallen into their hands. This turn of events is significant as ISIS can leverage their control of the Ain Zalah oil field to sell crude oil on the black market. It has been reported that ISIS is making up to $1 million per day off the sale of Iraqi crude oil — at a rate of $30 USD per barrel — significantly below the market price of ~$100 USD per barrel.

Control of Terrain in Iraq- August 10, 2014

The capture of the Ain Zalah oil field will enable them better funding to launch an offensive for one of Iraq’s largest oil fields- the Kirkuk oil field. After which ISIS is anticipated to consolidate their claims over the northern and Kurdish territories to ultimately head for Baghdad.

Iraq’s Pipelines and Ports

A major factor in Iraq’s ability to export its crude oil is through its network of pipelines and ports, which are currently largely unaffected by ISIS.

In terms of ports, ISIS has little interference with this infrastructure. Iraq is able to maintain a business-as-usual scenario since the country exports the majority of its crude oil through its port systems along the Persian Gulf. This is done primarily through the main Basrah Oil Terminal (capacity is an estimated 1.5 million bbl/d) and 5 other ports along the Persian Gulf. In 2012, Iraq upgraded its export capacity by an additional 1.6 million bbl/d via the completion of two mooring systems. The third, and last, scheduled mooring system is reported to be still under construction and would push the country’s export capacity to 4.5 million bbl/d.

Iraq Oil Infrastructure

In terms of pipelines, ISIS has little control over the current infrastructure until they are able to take control of the Kirkuk supergiant oil field. The Kirkuk oil field is connected to the country’s main export pipeline running from the Kirkuk to Turkey. The pipeline is reported to have a capacity of 1.65 million bbl/d, but is in need of severe maintenance due to neglect reducing its actual capacity to around 600,000 bbl/d. In addition, militant attacks along the pipeline have closed off certain sections.

ISIS taking control of Kirkuk could potentially open this pipeline up to the black market, but they will first have to fight off Kurdish forces first. Iraq’s two other pipelines, located in the West and East, will be a non-issue for ISIS as they have fallen into disuse.

ISIS’s Impact on Iraq’s Oil Industry

Short-Term:

ISIS’s control of Iraq is largely concentrated in the Northern and Northwestern Iraq, far from the country’s top producing oil fields and export infrastructure. As such, Iraq’s oil industry will be largely unaffected in the short-term. This point is illustrated by the lack of price hikes to global crude oil prices up to this date.

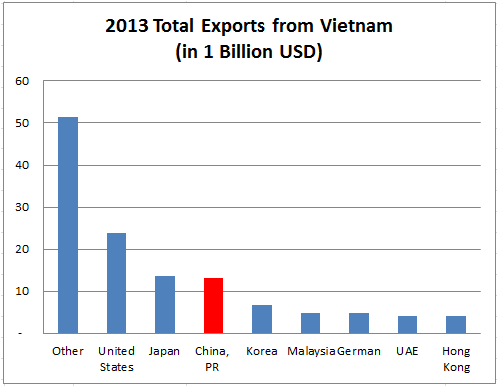

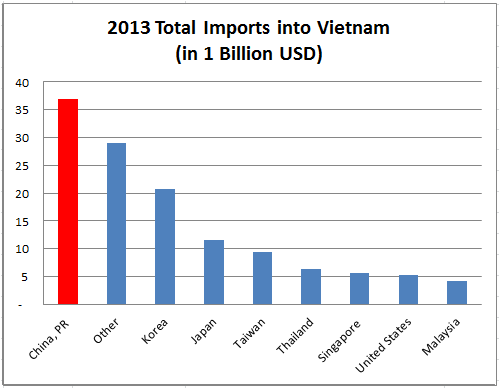

2012 Iraq Oil Exports

Risk, however, will still exist for Iraq’s top export destination countries which include China, India, South Korea, and the United States. These countries may need to start looking at other suppliers when ISIS starts heading further south. However, this seems unlikely as Southern Iraq is dominated by Shiite Muslims, offering ISIS few opportunities to gain the type of support, traction, or manpower they received from Sunni Muslim communities in the North.

Long-Term:

The true impact of ISIS on Iraq’s oil industry will not be felt for a few years.

Before the June 2014 ISIS offensive on Iraq, the International Energy Agency (IEA) predicted Iraq to account for 45% of the world’s global production growth through 2030. This meant an estimated 40% increase in production growth by 2019. However, with the political instability and infighting ISIS has presented, Iraq will be hard-pressed to achieve these goals.

For one, Iraq needs investment, infrastructure, and human capital to achieve their oil export dreams. This applies to the entire supply chain of the oil industry, from downstream exploration and production, to midstream pipelines, and to upstream refining. Iraq has a severe lack of resources, making the country’s economic growth extremely vulnerable in the years to come.

This is troubling for world markets facing increased demand for oil. We can expect Iraq’s oil production and export capacity to stay stagnant, which means that global crude oil prices may dramatically increase over the next decade.